“Unclaimed money is not lost money — it’s forgotten money.

A simple check today can help you reclaim what’s rightfully yours.”

Unclaimed Amounts in India: Your Money Awaits

Every year, thousands of crores of rupees lie dormant across India’s financial landscape. These unclaimed assets—spanning bank deposits, shares, insurance policies, and more—remain the rightful property of individuals and families who simply haven’t tracked or claimed them. After prescribed periods, funds transfer to government authorities, but the good news? They remain fully claimable by you or your heirs.

India’s Staggering Unclaimed Wealth: Over ₹1.9 Lakh Crore Awaits Claimants

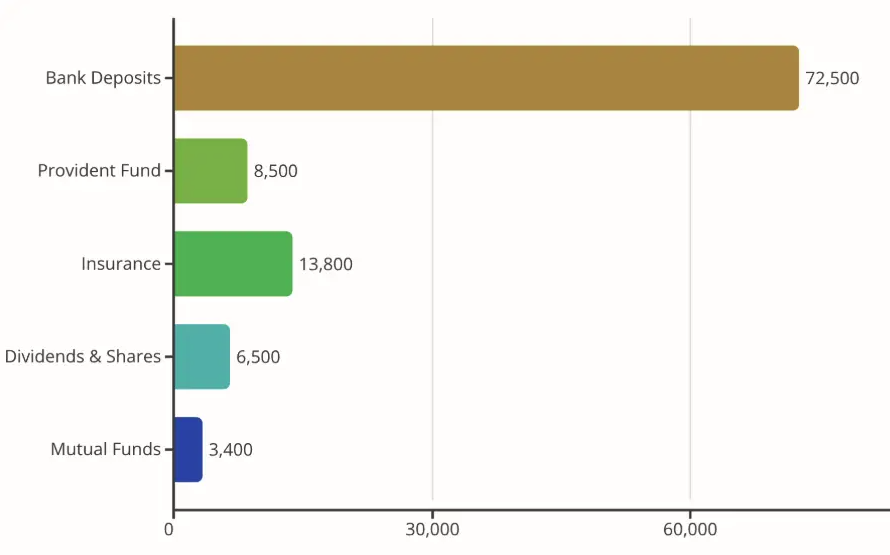

India’s unclaimed financial assets have reached staggering proportions, collectively estimated between ₹1.8 to ₹1.96 lakh crore. These amounts span multiple financial instruments, each with its own regulatory framework and claim process.

(Amount in Crores)

Sources include RBI, SEBI, IRDAI, and IEPF regulatory disclosures as of FY 2024-25.

Key Insight:

A staggering ₹72,500 Crore is held in unclaimed bank deposits alone, representing the largest portion of India’s dormant wealth. This highlights a significant opportunity for individuals to recover their rightful funds!

The total unclaimed amount across all categories exceeds ₹1.9 Lakh Crore.

Why Does Money Go Unclaimed?

Lost Contact Information

Address changes and new contact details aren’t updated with financial institutions, breaking communication.

Outdated KYC Details

Incomplete or obsolete KYC documents prevent institutions from reaching account holders.

Missing Nominations

Without proper nominee registration, heirs face difficulty accessing deceased family investments.

Forgotten Assets

Old accounts, inherited shares, or long-term deposits are simply forgotten over time.

Death Without Documentation

Investors passing away without informing heirs or maintaining clear records leads to orphaned assets.

Understanding Unclaimed Assets

India’s unclaimed amounts fall into distinct categories, each governed by specific regulations and claim procedures. Understanding these categories is the first step toward recovering your rightful assets or helping family members do the same.

Dividends & Shares (IEPF)

Unclaimed for 7 years, transferred to government fund

Bank Deposits (DEAF)

Dormant accounts inactive for 10+ years

Insurance Proceeds

Maturity benefits and death claims not collected

Provident Fund (EPF)

Old employer accounts and multiple PF balances

Mutual Funds

Unclaimed dividends and redemption proceeds

Bonds & Debentures

Interest payments and maturity proceeds unredeemed

Unclaimed Dividends & Shares (IEPF)

What Happens to Your Shares?

India’s unclaimed amounts fall into distinct categories, each governed by specific regulations and claim procedures. Understanding these categories is the first step toward recovering your rightful assets or helping family members do the same.

Common Reasons for Non-Claim

- Outdated contact details with company registrars

- Bank account information not updated

- Physical share certificates misplaced or lost

- Shareholder deceased without proper nomination

- Heirs unaware of investment portfolio

Unclaimed Bank Deposits (DEAF)

The Depositor Education and Awareness Fund (DEAF), maintained by the Reserve Bank of India, holds savings accounts, fixed deposits, and recurring deposits that have seen no customer-initiated transactions for 10 years.

Dormant Accounts

Salary accounts, savings accounts, and old banking relationships forgotten after job changes or relocations

Lost Records

Physical passbooks misplaced, online credentials forgotten, or inherited accounts without proper documentation

Address Changes

Moving cities or states without updating bank records, causing correspondence to fail and accounts to go dormant

Unclaimed Insurance Proceeds

Life insurance maturity proceeds, death claims, and survival benefits often remain uncollected when nominees or heirs are unaware of policies or unable to provide proper documentation. The Insurance Regulatory and Development Authority of India (IRDAI) oversees these unclaimed amounts.

Why Claims Go Unfiled

- Nominees don’t know policies exist or their rights

- Incomplete or incorrect claim documentation

- Contact details not updated with insurance companies

- Complex claim procedures discourage follow-through

Unclaimed Provident Fund (EPF)

Job Changes

Employees switch jobs without transferring or withdrawing PF balances from previous employers

Multiple Accounts

Unlinking Issues

Dormant Status

Unclaimed Mutual Funds & Bonds

What Happens to Your Shares?

These amounts accumulate when:

- Contact details or bank information becomes outdated

- Investment folios are forgotten or not actively managed

- Unit holders pass away without nominee registration

- Investors lose track during AMC mergers or consolidations

Bonds & Debentures

- Physical certificates lost or misplaced

- KYC details not updated with issuing authority

- Address changes not communicated to registrars

- Maturity dates forgotten or overlooked

Your Money is Waiting—Here’s What to Remember

Assets Remain Claimable

Even after transfer to DEAF, IEPF, or other regulatory funds, your money stays claimable indefinitely by rightful owners or legal heirs.

Documentation is Key

₹1.9L Cr

Total Unclaimed

6

Major Categories

100%

Recoverable

Take Action Today: Check for unclaimed assets in your name or your family’s name. Update your KYC details across all financial institutions, register nominees, and keep investment records organized. Your wealth deserves to work for you and your loved ones—not sit dormant in regulatory accounts.

Government Initiatives on Unclaimed Money

“Your Money, Your Right” Campaign

- Nationwide awareness and claim facilitation drive launched in October 2025

- Covers banks, insurance, dividends, mutual funds, and PF

Digital & On-Ground Support

- UDGAM, MITRA, Bima Bharosa, IEPFA portals

- District-level claim facilitation camps across India

Impact So Far

- ₹2,000 – ₹4,200 crore already returned to rightful owners

- Strong push toward financial inclusion and transparency

Reclaim What’s Already Yours

Your forgotten money. Our expertise. One simple journey.

A Simple, Transparent 3-Step Journey (From discovery to deposit — made effortless)

Discover

Document

Recover

Pay Only When You Get Paid (No recovery. No fees)

Performance-Based Fees

Success-Driven Payment

Risk-Free Engagement

Recovery is subject to regulatory processes and timelines. We do not guarantee recovery. However, we commit to full support and follow-up until the process concludes.